22Fun 🏅 22Fun Casino เป็นเว็บไซต์พนันออนไลน์ชั้นนำของประเทศไทย

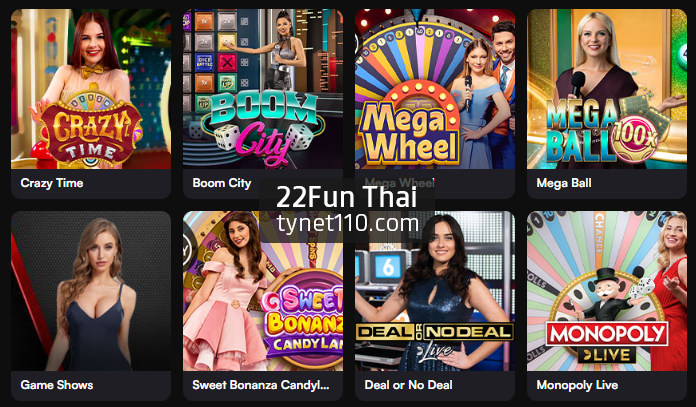

22Fun เป็นหนึ่งในเว็บไซต์การพนันที่เชื่อถือได้อันดับหนึ่งที่ได้รับการยอมรับทั่วโลก เราไม่เพียงแค่ให้บริการการเดิมพันกีฬา คาสิโนออนไลน์ เกมอีสปอร์ต คาสิโนออนไลน์ เกม Keno – ตรวจหวย และอื่นๆ อีกมากมาย 22Fun ยังมุ่งมั่นที่จะสร้างประสบการณ์ที่ดีที่สุดให้กับผู้เล่น

ด้วยการนำเสนอเทคโนโลยีชั้นนำ เรานำเสนอแพลตฟอร์มการเดิมพันที่ปลอดภัย เป็นธรรม และเป็นมิตร รวมถึงบริการลูกค้า 22Fun Casino ที่ให้การสนับสนุนอย่างมืออาชีพตลอด 24/7 มาเป็นกันเองให้พวกเราได้สัมผัสความตื่นเต้น ดрамาติดๆ และสนุกสนานในการชนะเลิศกันเถอะ!